CDBiNet spurs revolutionary breakthrough with WhatsApp & Viber

Uses social media platforms for fund transfers

Yet another first in the financial services industry in Sri Lanka

Optimising use of social media to maximise financial inclusiveness

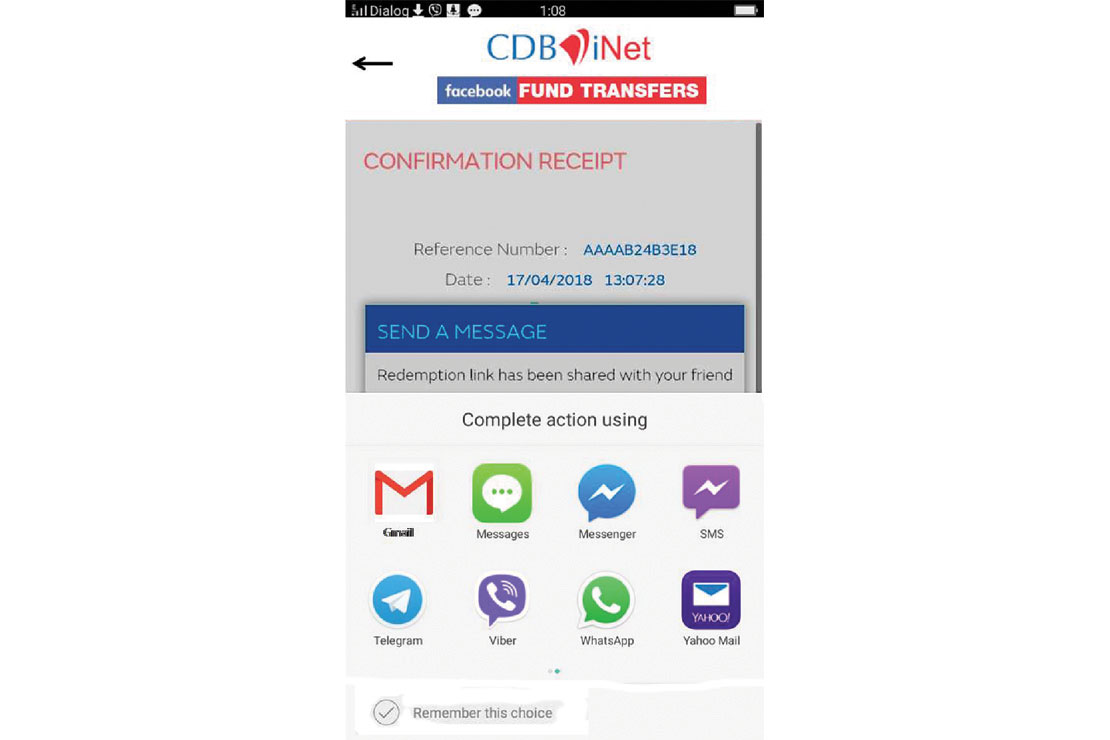

Trailblazing yet another revolutionary breakthrough in fund transfers in the country, Citizens Development Business Finance PLC (CDB) is pushing boundaries with its pioneering CDBiNet to enable fund transfers through the social media platforms such as Facebook, WhatsApp, Viber, Email Messages & Text Messages, the very first such initiative in the country. CDBiNet already broke records by enabling fund transfers through Facebook not too long ago, which has now become a popular transaction mode among its customers given the conveniences of not requiring the bank details of the fund recipient when transferring funds. These conveniences have now expanded to WhatsApp, Viber and many other popular social media platforms.

CDBiNet, the first of its kind e-finance platform in Sri Lanka, transformed the entire financial services industry when it was introduced in June last year. Hosting an expansive range of facilities and services which includes the opening of savings accounts and fixed deposits to utility bill payments, application for VISA debit cards, fund transfers, information on leases and loans and online rental payments, CDBiNet is open to all CDB Savings Account Holders.

Furthermore, a CDB Savings Account can be opened by anyone using a smart phone, desktop, or laptop without the need to visit a branch—the most convenient method to open a savings account. Although accounts created online allow transactions only through the Internet, customers can upgrade such accounts to conventional savings accounts by simply visiting any CDB branch, availing themselves of all these facilities through CDBiNet. The revolutionary finance platform enables all these services with the simple click of a button or via a smartphone. By adding the fund transfer facility now on Facebook, WhatsApp, Viber and many other social media platforms, CDB has stepped onto a pioneering technology innovation platform that brings with it a fundamental competitive edge to the entirety of the financial services industry.

With a penchant for pushing CDB’s pioneering psyche into innovative breakthroughs, MD/CEO of CDB Mahesh Nanayakkara believes that CDB’s ultimate vision to become a financial powerhouse is the overarching focus that drives his team to reach new heights. “Our customers remain integral to our success and it is to them that we offer these innovations because it is our responsibility to ensure that our products and services far exceed their aspirations. Technology is a key driver to that success and that constant quest to break moulds remain embedded in everything we do. By adding WhatsApp and Viber into the fund transfer features we already have with Facebook, we have pushed frontiers in technological innovation, adding immense value to our online and offline service strategies.”

Reiterating the benefits that will result from this unique fund transfer method, CDB’s General Manager – Emergent Business Information Technology Imdaad Naguib explains that an iNet customer can send funds via any mobile device or computer and inbox the fund transfer through several messaging or social media platforms, namely Whatsapp, Viber, Facebook, SMS or Email. “The biggest advantage is not having to share individual bank details with the sender when using any of these transfer facilities, which means security and confidentiality remains uncompromised. Further, the recipient can deposit the money received via Facebook or several other social media platforms to any preferred bank account via any mobile device or computer. A unique four-digit alphabetic passcode gives access to the recipient to access the funds.” He adds to the conveniences saying, “From sending gifts to helping a friend in need or even making a donation to a worthy cause, using Facebook, WhatsApp, Viber and many other social media channels make fund transfers most expedient.”